However, the company actually delivered cash flow from operations of $97 million during the quarter. Shopify would record a net loss of $623.7 million, around 36% of revenue, during its fourth quarter due to the impact of one-time items. Slower subscription revenue growth and a higher dependence on its GMV take for revenue have weighed down on Shopify's overall profitability. However, both companies have been experiencing margin compression over the last three years, albeit with Wix stabilizing its decline as Shopify's margin continues to move lower. Gross profit margin for Wix came in at 63.7% for the fourth quarter, ahead of Shopify's 46% margin. Critically, Wix's gross profit margins are ahead of Shopify's on the back of its higher margin recurring revenue forming a larger percentage of total revenue. Creative subscription revenue was $265.3 million, up 8% over the year-ago comp and around 100 basis points ahead of Shopify's core recurring subscription revenue growth. This was also a beat by $3.12 million on consensus estimates. Wix recorded fiscal 2022 fourth-quarter revenue of $355 million, up 6% over the year-ago quarter, around 8% growth on a constant currency basis. Monthly recurring revenue recorded slower growth, up by 7% year-over-year to $109.5 million but still ahead of a consensus of $106.1 million. GMV was $61 billion for the fourth quarter, up 13% from its year-ago comp, this was around 17% growth on a constant currency basis. Shopify's fiscal 2022 fourth-quarter earnings brought in revenue of $1.73 billion, a 25.4% increase from the year-ago comp and a beat by $80 million on consensus estimates. Bears would be right to flag that both these are skewed by the boisterous pandemic years and that future sales momentum will be slower. Wix is trading at a 60.8% discount to its 5-year average multiple of 9.26x with Shopify trading at a similar 63.4% discount to its 5-year average multiple of 29.42x. Whilst their previous sales multiples were always going to be unsustainable, both are currently trading at marked discounts to their 5-year averages. Shopify currently trades on a price-to-sales multiple of 10.76x versus Wix's 3.6x multiple to reflect more buoyant investor euphoria for eCommerce over Wix's content-based website tilt. These highs are firmly in the rearview but expose just how deep stock market euphoria was for eCommerce plays as stay-at-home orders kept their brick-and-mortar competitors shut. Take a time machine back to 2020 and Shopify was trading at 60x sales with Wix trading at 20x sales. Valuation Divergence, Revenue, And Profitability Both are down markedly over the last year as a comedown from pandemic-induced revenue highs and rising Fed funds rate aggregated to compress valuation multiples.

#SHOPIFY CHECKOUT PLUS#

eCommerce usage distribution in the top 1 million sites gives Shopify a 21% market share with Shopify Plus at 5%, both ahead of Wix Stores at 3%. However, whilst there are at least 8.5 million websites powered by $4.6 billion market cap Wix versus 4.2 million websites powered by Shopify, the leadership difference in eCommerce for both is marked. Picking the right online store builder is crucial as it's the backbone of operations and a core factor for scaling. For entrepreneurs, the $67.4 billion market cap Shopify likely offers a better more eCommerce native platform. Essentially if you want to create a blog, brochure site, or showcase your portfolio, then you go with Wix. Tel Aviv, Israel-based Wix primarily offers tools to build content sites with eCommerce essentially offered as a secondary almost side offering.

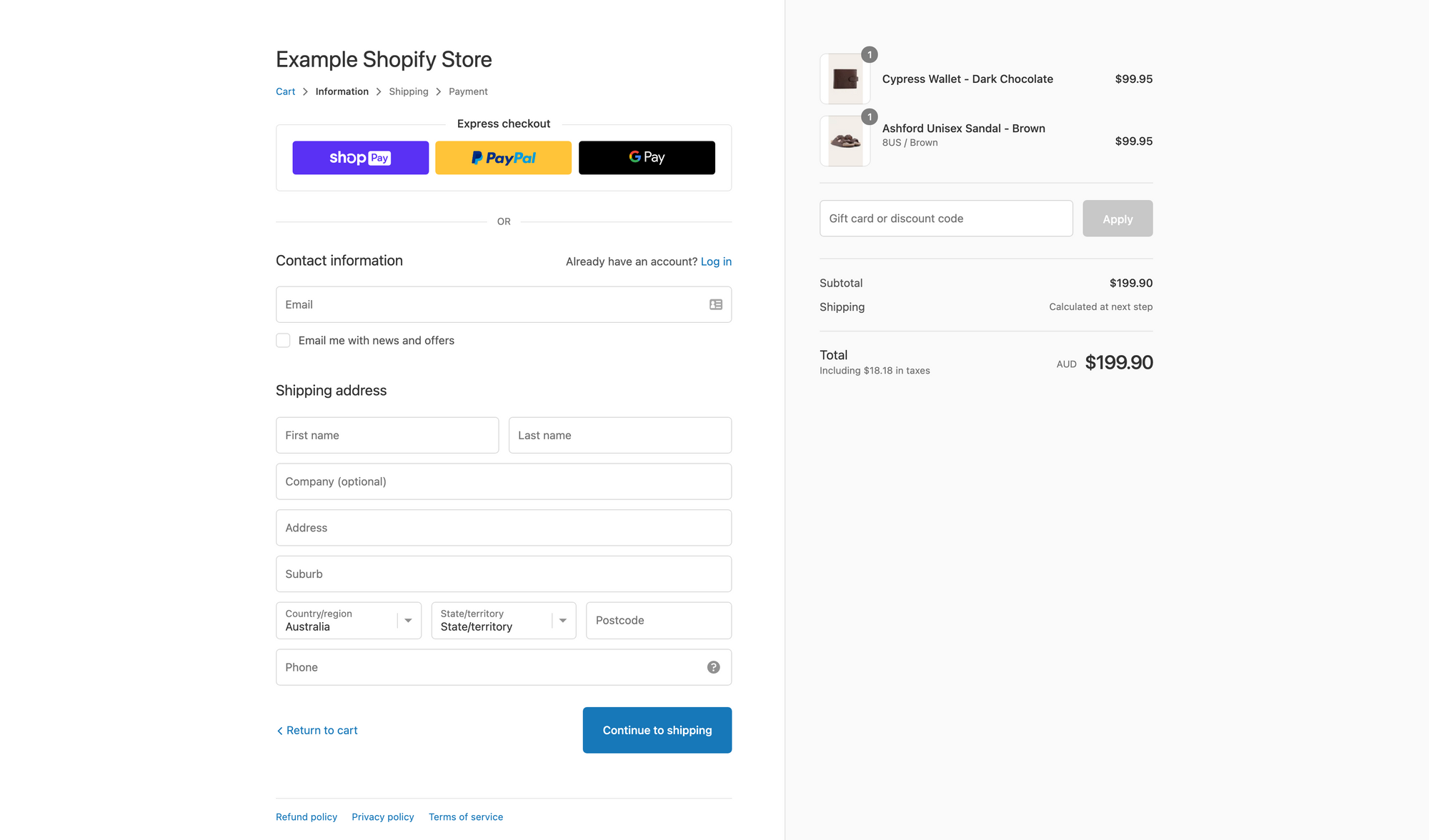

It boasts a range of third-party eCommerce tools that allow a deeper relationship and a more bespoke customer experience to be curated by the businesses onboarded to its platform. Ottawa, Ontario-based Shopify is admittedly the more extensive platform for facilitating online sales. Should you go with Shopify ( NYSE: SHOP) or Wix ( NASDAQ: WIX) in the battle for eCommerce dominance? Both companies offer entrepreneurs a platform to build an online store, take payments, and manage email marketing and shipping to realize ambitions to sell into a global market.

0 kommentar(er)

0 kommentar(er)